Can a breath-activated gadget really lower your car-insurance bill?

1. The Two-Minute Take

- A DUI pushes auto premiums up by about 80%.

- Interlocks cut repeat offenses roughly 70%, so they look good to insurers.

- A few carriers already test 5% to 15% “safety-device” credits.

- Voluntary installation gives you the most leverage when you negotiate.

2. Why Your Insurance Skyrocketed

Insurers price risk first. Statistics show that drivers with a DUI crash four to six times more often than sober drivers, so carriers add hundreds or thousands of dollars per year. An SR-22 filing stacks on administrative fees, then the actuarial surcharge lands. Recent surveys place an average post-DUI policy near $3,300 per year.

3. What Makes Insurers Budge

- Proof your risk is lower (technology or training).

- Data they can verify (device logs, DMV reports).

- Regulatory nudges or pilot programs that encourage discounts.

An ignition interlock checks each box. The unit prevents impaired driving, stores tamper-proof data and appears in several insurer pilot studies.

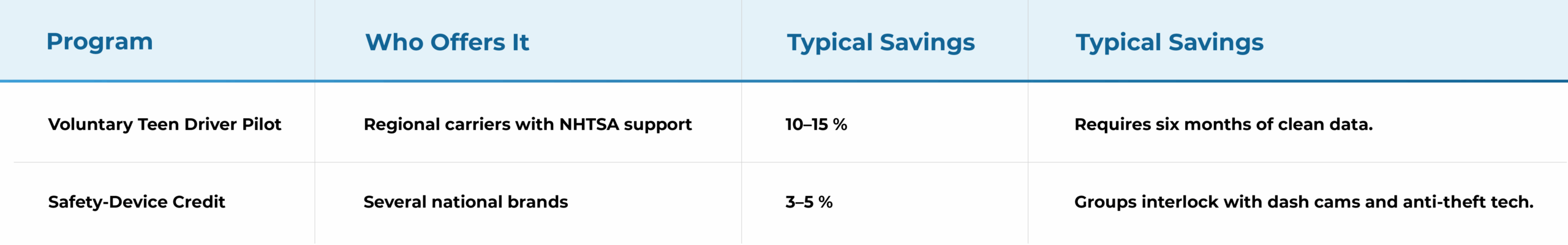

4. Interlock Discounts in the Wild

5. SR-22 and Interlock: Double Trouble or Double Win

The SR-22 proves coverage after a violation, while the interlock proves safe behavior. Ask your agent to rerate the policy midway through the term once you have several months of clean interlock reports.

6. How to Chase the Discount

- Collect compliance printouts or calibration receipts.

- Call underwriting directly, not just the sales desk.

- Use this script:

“I installed an ignition interlock, which federal studies show cuts repeat DUI by seventy percent. Do you offer a safety-device discount or a reduced high-risk surcharge for verified interlock users?” - Compare at least three quotes.

- Save all emails and revised premium breakdowns.

7. Quick Math Check

- Average post-DUI premium: $3,300

- 10% interlock credit: $330

- Interlock fee (twelve months at $80): $960.

- Net year-one cost: $630 above a non-interlock scenario. Courts often mandate the device, so the credit softens the hit.

For voluntary users with standard premiums, a five-percent safety-device credit can offset a three-month trial cost and even leave enough cash for date-night pizza.

8. When the Discount Fails

- Mandatory installations may not earn credit because they are court-ordered.

- A few states bar insurers from factoring the device into rates.

- Some adjusters have never encountered an interlock request, so be patient and persistent.

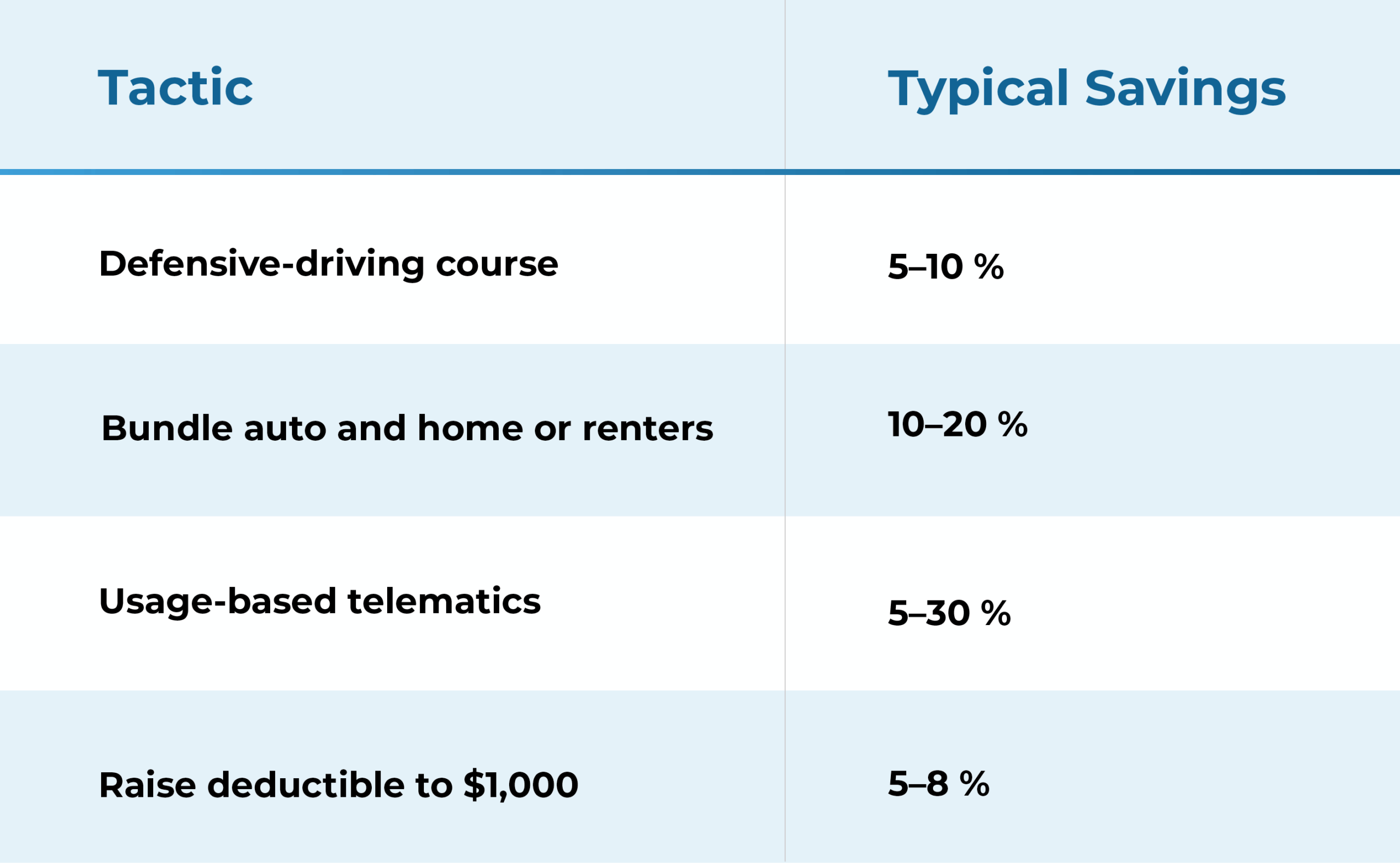

9. Extra Ways to Trim Premiums

10. Key Takeaways

An interlock plus a proactive phone call can lower premiums, especially when the device is voluntary. Keep spotless device logs, shop every renewal period and remember that persistence pays.